GMR Airports Limited

(formerly GMR Airports Infrastructure Limited)

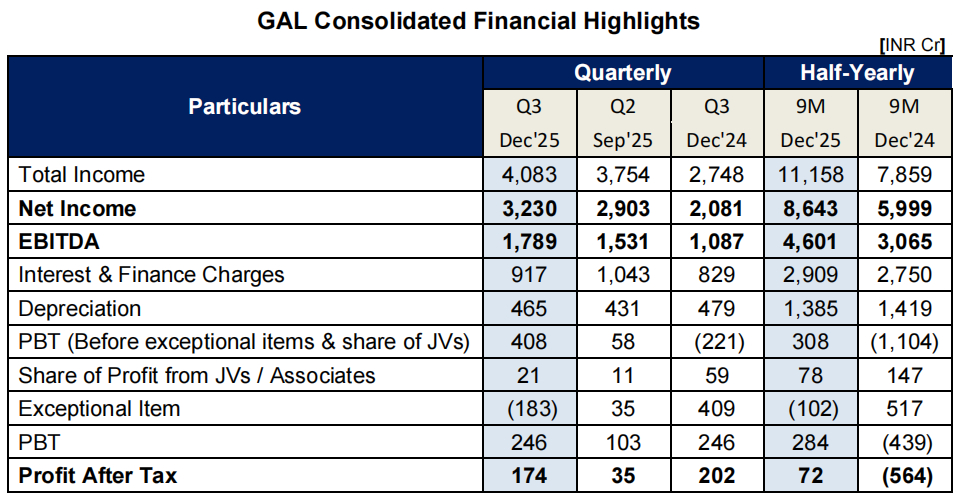

Total Income increased by 49% YoY to INR 4,083 Crs in Q3FY26

EBITDA continues to create new highs, increasing by 65% YoY to INR 1,789 Crs in Q3FY26

- Delhi Airport – Reported highest ever EBITDA

- Hyderabad Airport – EBITDA near record highs

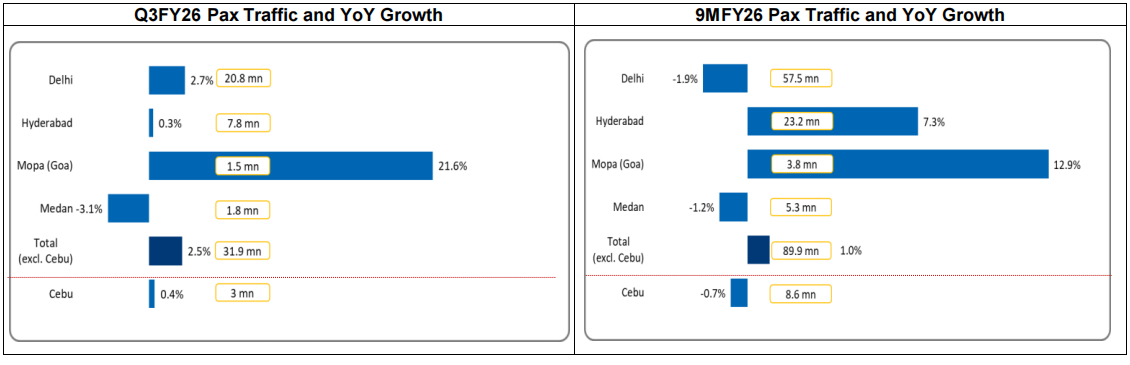

GAL owned airports handled record 31.9 mn passengers in Q3FY26

- Delhi Airport - Handled record 20.8mn passengers

- Hyderabad Airport - Handled 7.8mn passengers

- Mopa (Goa) Airport – Handled record 1.46mn passengers

Key Developments

Hyderabad Airport declared an interim dividend

- The Board of Directors of GMR Hyderabad International Airport Ltd. in its board meeting held on 29 Jan’26 declared an interim dividend of INR 7.5/share, aggregating to a total of INR 283.5 Crs

Steady progress in Airport adjacency businesses (“GAL Platform”)

- Duty Free:

- Both Delhi and Hyderabad Duty Free achieved highest ever monthly sales in Dec’25

- Work on expanding Hyderabad Duty Free store at departure in progress – Operationalizing stores in phases

- Cargo: Delhi Cargo Terminal handled highest ever monthly cargo tonnage in Dec’25

- F&B: Phase-wise opening of F&B outlets at Hyderabad ongoing

Refinancing Activities

- Hyderabad Airport (GHIAL): Raised1 INR 21bn 15-year Non-Convertible Debentures (NCDs) and used the proceeds to refinance dollar denominated debt. The NCDs carry a coupon of 7.6% p.a resulting in expected savings in interest cost of more than 150bps. CRISIL Ratings revised its outlook on GHIAL to ‘Positive’ from ‘Stable’ while reaffirming the rating at ‘Crisil AA+’

- GMR Cargo and Logistics Limited (“GCLL”), a wholly owned subsidiary of GAL, availed Rupee Term Loan Facility for an aggregate principal amount not exceeding INR 7.5bn to enable it to meet a part of the estimated project cost towards developing the Cargo City at Delhi International Airport (DIAL)

Steadily advancing Airport Land Development activities

- DIAL:

- Construction underway on:

- Self-development project – Commercial office building with ~1mn sq.ft. built-up area (BUA)

- Build to suit Luxury Hotel (~380 keys) with ~0.6mn sq.ft. BUA

- GHIAL:

- Construction of Safran’s MRO (0.46mn sq.ft. BUA) facility completed and inaugurated by Hon. Prime Minister Shri Narendra Modi on 26 Nov’25

- Construction underway on:

- Self-development project – GMR Interchange (GAL’s First Retail Project) with ~0.77mn sq.ft. BUA and ~0.55mn sq. ft. leasable area

- Mopa (Goa): Third Party Hotel Projects (4 hotel projects of ~0.75mn sq.ft. BUA and ~1,000 keys) under various stages of construction / approvals

1 Corporate Announcement dated 22 Jan’26;

ESG Initiatives

- GAL published the sustainability report for FY25. Key highlights being:

- Environment:

- 100% clean electricity sourcing at Delhi and Hyderabad Airports

- 2,18,747 tCO2e emissions avoided in FY25 through clean energy

- 42% of water consumption through recycled water

- Delhi Airport became 1st Indian Airport to receive IGBC Net Zero Waste to Landfill Platinum Certification

- Social:

- 1 Lakh+ lives positively impacted through CSR programmes with GMR Varalakshmi Foundation

- INR 240.2mn spent on CSR in FY25

- 17,956 employee strength including permanent and contractual employees

- 2,000+ employees participating in voluntary CSR campaigns

- Governance:

- 75% of procurement spends assessed on ESG criteria

- 100% awareness across workforce on ethics-related aspects

- ESG integration into performance evaluation

- 100% of operating airports certified as per ISO 14001 and 45001

- DIAL:

- ICRA assigned a combined ESG rating of 77 [Strong] to DIAL

- Awarded Water Positive status meaning DIAL restores more water back to the environment than it is utilizing. Became the first airport in India with 40mn annual capacity to achieve this

Awards, Recognition and Accomplishments - Continuing to innovate and excel

- DIAL:

- Adjudged as the “Best Airport of the Year” at Wings India 2026 and named “Sustainability Champion”

- GHIAL:

- GMR Aero Technic awarded as “Best MRO Services” at Wings India 2026

- GMR Hyderabad Air Cargo (GHAC) awarded the Gold Award for "Time Critical Logistics Solution Provider of the Year" at the Southeast Air Cargo Conclave and Awards 2025

- GHAC conferred the CII Scale 2025 Award for Terminal Operator- Air Cargo, recognising its performance in operational excellence, technology adoption, inclusivity and sustainable cargo-handling practices

- Aerocity secured 2 major recognitions:

- Tower 2, Safran Electric Power and Safran Aircraft Engine received the EDGE (Excellence in Design for Greater Efficiencies) Certification from IFC (International Finance Corporation)

- GMR Aeroscpace and Industrial Park awarded the FICCI Swachh Industrial Park Award 2025 - the only private industrial park in Telangana to earn this national distinction

- Business Excellence (BE) Maturity Award – Gold: Awarded to Hyderabad, Mopa (Goa) and Bhogapuram Airports at the CII Excellence Summit 2025

Traffic Trend

Record quarterly traffic handled by Delhi and Mopa (Goa) Airports

Q3FY26 Performance Highlights

Domestic Airports

Delhi Airport (DIAL)

- Traffic Insight

- Q3FY26: Pax traffic at 20.8mn, up by 2.7% YoY from 20.3mn in Q3FY25. Q3FY26 was the highest quarterly traffic on record

- Domestic traffic increased by 3% (despite disruptions in December) while International traffic increased by 2% YoY

- 9MFY26: Pax traffic at 57.5mn, down by 1.9% YoY from 58.6mn in 9MFY25

- Domestic traffic decreased by 3% while International traffic increased 0.5% YoY

- Key Financials

- Total Income:

- Q3FY26: Increased to INR 2,019 Crs, up by 41% YoY from INR 1,430 Crs in Q3FY25 driven by aero revenues which rose 173% YoY post implementation of revised tariffs. Non-aero revenues up 11% YoY in Q3FY26

- 9MFY26: Increased to INR 5,634 Crs, up by 38% YoY from INR 4,097 Crs in 9MFY25

- EBITDA:

- Q3FY26: Increased to INR 825 Crs, up by 89% YoY from INR 435 Crs in Q3FY25. Q3FY26 EBITDA at record highs

- 9MFY26: Increased to INR 2,134 Crs, up by 74% YoY from INR 1,226 Crs in 9MFY25

- PAT:

- Q3FY26: Reported PAT of INR 231 Crs vs. loss of INR 243 Crs in Q3FY25. PAT for the quarter highest since Q3FY22

- 9MFY26: Reported PAT of INR 354 Crs vs. loss of INR 917 Crs in 9MFY25

- Witnessed a 34% YoY increase in East-West-East transit passengers during 12 months ending Aug’25 underscoring Delhi’s growing relevance as a preferred international transit / transfer point between Asia and Europe

- DEL-BOM remained the 8th busiest route globally in 2025

- Terminal 2 commenced operation from 26 Oct’25 after upgradation

- Resumed direct connectivity to China – Shanghai and Guangzhou

- Handled highest-ever cargo volumes of ~0.86mnt in YTD FY26

- Enhancing terminal offerings:

- New F&B concessions awarded: DIAL awarded concession to design, develop, set up, operate, manage and maintain a total of 47 F&B outlets at Terminal 2 and Terminal 3

- Destinations connected – 85 Domestic destinations & 72 International destinations

Hyderabad Airport (GHIAL)

- Traffic Insight

- Q3FY26: Pax traffic at 7.8mn, almost unchanged vs. Q3FY25

- Domestic traffic decreased by 2% (due to disruptions in December) while International traffic increased by 12% YoY

- 9MFY26: Pax traffic at 23.2mn, up by 7.3% YoY from 21.6mn in 9MFY25

- Domestic traffic increased by 6% YoY while International traffic increased by 12% YoY

- Key Financials

- Total Income:

- Q3FY26: Increased to INR 659 Crs, up by 8.2% YoY from INR 609 Crs in Q3FY25 with Aero Revenue up 5.6% YoY and Non-Aero Revenue up 23.7% YoY

- 9MFY26: Increased to INR 1,957 Crs, up by 11.1% YoY from INR 1,761 Crs in 9MFY25

- EBITDA:

- Q3FY26: Increased to INR 429 Crs, up by 10.9% YoY from INR 387 Crs in Q3FY25. Quarterly EBITDA continued to be near record highs

- 9MFY26: Increased to INR 1,249 Crs, up by 11.8% YoY from INR 1,117 Crs in 9MFY25

- PAT:

- Q3FY26: Reported PAT of INR 86 Crs vs INR 61 Crs in Q3FY25

- 9MFY26: Reported PAT of INR 248 Crs up by 55.1% from INR 160 Crs in 9MFY25

- Declared1 an interim dividend of INR 7.5/share, aggregating to INR 2.8bn

- Raised2 INR 21bn 15-year Non-Convertible Debentures (NCDs) carrying coupon of 7.6% p.a. and used the proceeds to refinance dollar denominated debt. Expected savings in interest cost of more than 150bps. CRISIL Ratings revised its outlook on GHIAL to ‘Positive’ from ‘Stable’ while reaffirming the rating at ‘Crisil AA+’

- Handled highest-ever cargo volumes of ~1.4 Lakh mt in YTD FY26

- Enhancing terminal offerings: Opened Tim Hortons, Farzi Café, Frank Hot Dogs, and Pretty Women outlets in the terminal

- National Council of Applied Economic Research (NCAER) released a study on Estimating the Economic Impact of Rajiv Gandhi International Airport in Dec’25

- Airport ecosystem (including the Aerocity), generated an estimated Gross Value Added (GVA) of INR753bn and supported 411,386 jobs in FY25 (direct, indirect, and induced impact)

- XDLINX Space Labs signed agreement with GMR Aerocity Hyderabad to establish a state-of-art satellite research and development facility at GMR Aerospace Park

- Destinations connected – 74 Domestic destinations & 26 International destinations

Mopa (Goa) Airport

- Traffic Insight

- Q3FY26: Pax traffic at 1.46mn, up by 22% YoY from 1.20mn in Q3FY25. Q3FY26 was the highest quarterly traffic on record

- Domestic traffic increased by 24% while International traffic decreased by 3% YoY

- Captured ~47% market share (of Goa system traffic) in Q3FY26

- 9MFY26: Pax traffic at 3.82mn, up by 13% YoY from 3.39mn in 9MFY25

- Domestic traffic increased by 12% while International traffic increased by 24% YoY

- Key Financials:

- Total Income

- Q3FY26: Decreased to INR 106 Crs, down by 14.7% YoY from INR 124 Crs in Q3FY25 as Aero Revenues decreased 15.8% YoY as it includes impact of special initiative program to attract airlines. Non Aero Revenues increased by 30% YoY

- 9MFY26: Decreased to INR 292 Crs, down by 7.8% YoY from INR 317 Crs in 9MFY25

- EBITDA

- Q3FY26: Decreased to INR 42 Crs, down by 34% YoY from INR 63 Crs in Q3FY25

- 9MFY26: Decreased to INR 77 Crs, down by 46% YoY from INR 144 Crs in 9MFY25

- Enhancing terminal offerings: Opened Chaayos, Neo Travel Outlet and 3 new Confectionery, Tobacco and News (CTN) stores

- India’s First seasonal cargo flight (to Antarctica) operated by Air Shagoon on 1 Oct’25

- Destinations connected – 24 Domestic destinations & 13 International destinations:

- New domestic destinations added: Navi Mumbai (IndiGo, Akasa & Air India Express)Resumptions during Winter Schedule Chandigarh, Ranchi by IndiGo

- New international destinations added: Almaty & Astana (Fly Arystan); Novosibirsk (Aeroflot)Resumptions during winter Schedule Manchester, Gatwick by TUI, Warsaw & Katowice by Enter Air, Tashkent by Uzbekistan Airways, Moscow & Yekaterinburg by Aeroflot, Muscat by Oman air

1 Corporate Announcement dated 29 Jan’26; 2 Corporate Announcement dated 22 Jan’26

Bhogapuram Airport (Visakhapatnam, Andhra Pradesh)

- Physical progress of ~95.8% achieved by Dec’25:

- Airside works ~100% complete

- Terminal building ~95.5% complete and

- Air Traffic Control tower ~94% complete

- Declared as a ‘Major Airport’ by AERA in Aug’25

- Validation flight successfully completed

- Aim to operationalize airport by Q2FY27, earlier than original completion target of Dec’26

International Airports

Medan Airport (Indonesia)

- Traffic Insight

- Q3FY26: Pax traffic at 1.76mn, down by 3% YoY from 1.82mn in Q3FY25

- Domestic traffic decreased by 7% while International traffic increased by 6% YoY

- Domestic pax growth continues to be impacted by delay in reactivation of fleets by airlines

- 9MFY26: Pax traffic at 5.30mn, down by 1.2% vs 9MFY25

- Key Financials

- Total Income

- Q3FY26: Increased to INR 144 Crs, up by 7.2% YoY from INR 135 Crs in Q3FY25 with Aero Revenue up almost unchanged YoY and Non-Aero Revenue up 16.6% YoY

- 9MFY26: Increased to INR 423 Crs, up by 8.9% YoY from INR 388 Crs in 9MFY25

- EBITDA

- Q3FY26: Increased to INR 42 Crs, up by 64% YoY from INR 26 Crs in Q3FY25

- 9MFY26: Increased to INR 107 Crs, up by 43% YoY from INR 75 Crs in 9MFY25

- Started operating departure duty free w.e.f 16 Jun’25

- Destinations connected – 20 Domestic & 7 International destinations

Crete Airport (Greece)

- Project is fully funded mainly through State Grant (which is already received) and Airport Modernisation & Development Tax. It is a debt free project

- Overall progress of ~65% achieved as of Dec’25. Work steadily progressing on multiple fronts

About GMR Airports Limited (Formerly GMR Airports Infrastructure Limited)

GMR Airports Limited (GAL) is a leading global airport platform company with over two decades of experience in designing, constructing, and operating world-class sustainable airports. Under the brand name “GMR AERO”, it offers pioneering aviation solutions in retail, aero services, and real estate. Groupe ADP joined the journey in 2020 as a strategic partner and is now a co-promoter in GAL.

As a platform business, GAL also provides a range of aero services including Duty Free, Retail, F&B, Cargo, Car Parking, O&M, and PMC services. Through its innovative Aerotropolis concept, it develops cutting-edge airport cities giving shape to best-in-class real estate developments in South Asia. GAL operates India's largest third-party Maintenance, Repair, and Overhaul (MRO) facility through its subsidiary, GMR Air Cargo and Aerospace Engineering Limited ensuring operational excellence across the Asia Pacific region.

GMR Innovex, a GMR Group entity, is developing and introducing a range of digital solutions to enhance the passenger journey and airport experience. Through GMR Aero Academy and GMR School of Aviation, the company is creating the talent pool necessary to drive the growth of the aviation sector in India (the third largest in the world).

As the largest private airport operator in Asia and the second-largest globally, GAL served over 120 million passengers in FY25 with a steadfast commitment to excellence in airport management as reflected in its consistent rankings for services by ACI and Skytrax. With a robust presence in India and Southeast Asia, the company operates key gateways such as Delhi, Hyderabad, Goa, and Medan airports, while extending its technical services to Mactan Cebu International Airport in the Philippines. GAL is also developing transformative projects like the greenfield airports in Bhogapuram Visakhapatnam), India, and Crete, Greece.

GMR Group, the promoter of GAL has a significant presence in Energy, Transportation, Urban Infrastructure, and Sports. Through its CSR arm, GMR Varalakshmi Foundation, GMR supports local communities, reflecting its commitment to improving quality of life by enhancing skills, providing education, and developing healthcare infrastructure and services.

Groupe ADP develops and manages airports, including Paris-Charles de Gaulle, Paris-Orly, and Paris-Le Bourget. In 2024, the group handled through its brand Paris Aéroport 103.4 million passengers at Paris-Charles de Gaulle and Paris-Orly, and nearly 363.7 million passengers in airports in France and abroad. Boasting an exceptional geographic location and a major catchment area, the Group is pursuing its strategy of adapting and modernizing its terminal facilities and upgrading the quality of services; the group also intends to develop its retail and real estate businesses. In 2024, group revenue stood at €6,158 million and net income at €342 million.4 million passengers at Paris-Charles de Gaulle and Paris-Orly, and nearly 363.7 million passengers in airports in France and abroad. Boasting an exceptional geographic location and a major catchment area, the Group is pursuing its strategy of adapting and modernizing its terminal facilities and upgrading the quality of services; the group also intends to develop its retail and real estate businesses. In 2024, group revenue stood at €6,158 million and net income at €342 million.

For further information about GMR Group, visit https://www.gmrgroup.in

Prateek Chatterjee

Group Chief Communications Officer,

Email: Prateek.Chatterjee@gmrgroup.in

Subhendu Ray

COE Head-Media Relations,

Email: subhendu.ray@gmrgroup.in