GMR Airports Limited

(formerly GMR Airports Infrastructure Limited)

Performance continues to trend upwards at GMR Airports

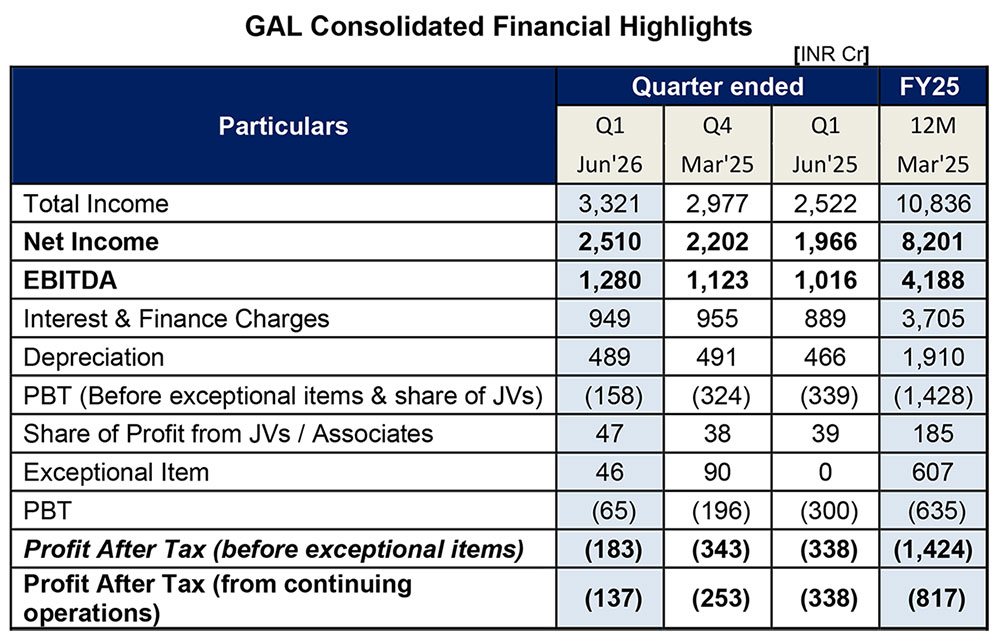

Total Income increased by 32% YoY to INR 3,321 Crs in Q1FY26

EBITDA increased by 26% YoY to INR 1,280 Crs in Q1FY26 to a record high

-

Delhi Airport – Reported highest EBITDA since Q1FY22

-

Hyderabad Airport – Reported record EBITDA

Hyderabad Airport declared second dividend of INR 2.5/shr for FY25. Total dividends for FY25 declared by Hyderabad Airport at INR 10/shr (INR 378 Crs)

Total Pax Traffic at GAL owned airports increased by 4% YoY to 30.1 mn in Q1FY26

-

Delhi Airport - Handled 19.1mn Pax in Q1FY26

-

Hyderabad Airport - Handled highest ever quarterly traffic of 8.1mn Pax in Q1FY26

Key Developments

Tariff Order for Delhi International Airport Ltd. (DIAL) for Control Period (CP) 4 issued by AERA1

AERA issued Final Tariff Order for CP4 with respect to DIAL. New tariffs have been implemented resulting in significant improvement in Delhi Airport financials

TDSAT2 quashed and set aside the calculation of Hypothetical RAB (HRAB) by AERA for DIAL

Hon. Supreme Court of India had directed TDSAT to opine on computation of HRAB by AERA in light of certain developments. After carefully examining the additional evidence and arguments from concerned parties, TDSAT directed AERA to include both aeronautical as well as non-aeronautical revenues and costs for FY 2008-09 while arriving at the calculation of HRAB. It has also directed AERA to complete the exercise of calculation of HRAB afresh within a period of 12 weeks from 1 Jul’25 (the date of the order)

Hyderabad Airport declared second dividend for FY25

The Board of Directors of GMR Hyderabad International Airport Ltd., a subsidiary of GAL, declared3 the second dividend of INR 2.5/share for FY25, totaling ~INR 95 Crores. With this, the total dividend for FY25 declared by the airport stands at INR 10/share, totaling ~INR 378 Crores

Steady progress on creation of “GAL Platform” to foray into Airport adjacency businesses

-

Delhi Cargo: GAL has been granted4 the concession to Operate, Maintain and Manage the existing Cargo Terminal on similar terms to ensure continuity of operations, post termination of existing concession to one of the cargo operator due to revocation of Security Clearance. GAL Q1FY26 results reflect partial financials; full quarter benefit to accrue from Q2FY26

-

Delhi Duty Free: Process of takeover completed in Jul’25 and GAL started operating duty free business from 28 Jul’25. GAL financials to see further improvement from Q2FY26

-

Hyderabad Duty Free: GAL to take over operations within Q2FY26

-

Hyderabad F&B: GMR Hospitality Limited (GHL) operationalized 25 self operated outlets till 30 Jun’25

1Airports Economic Regulatory Authority of India; 2Telecom Disputes Settlement and Appellate Tribunal; 3Corporate Announcement dated 23 Jul’25; 4Corporate Announcement dated 16 May’25

Steadily advancing Airport Land Development activities

-

DIAL:

-

Signed an agreement with Hilton Hotels & Resort for the development of Hotels under Waldorf (150 rooms) & Hilton (350 rooms) brands

-

Construction underway on:

-

Self-development– Commercial office building with ~1mn sq.ft. built-up area (BUA)

-

Build to suit Luxury Hotel with ~0.6mn sq.ft. BUA

-

Other third-party projects with ~12mn sq.ft. BUA

Concluded acquisition of 70% stake in ESR GMR Logistics Park Private Limited (“EGLPPL”)1

GHIAL concluded the Share Purchase Agreement (SPA) to acquire 70% stake in ESR GMR Logistics Park Private Limited (“EGLPPL”) with other shareholders of EGLPPL at a consideration of up to ~INR 41.3 Crs. EGLPPL has now become a wholly owned subsidiary of GHIAL. This transaction will further strengthen Airport based Industrial and Warehousing portfolio

Credit ratings of GAL and DIAL upgraded, reinforcing confidence on future profitability and cash flow generation

-

GAL:

-

CRISIL assigned3 ‘Crisil A+/Stable’ Rating for the proposed INR 60bn NCDs4

-

CARE upgraded2 credit rating for GAL’s Rupee denominated, rated and listed Non-convertible Bond (NCB) to CARE A; Outlook: Stable from CARE BBB+; Outlook: Stable

-

DIAL:

-

India Ratings and Research upgraded DIAL’s debt instruments to ‘IND AA’ with a Stable Outlook from ‘IND AA-’

-

Mopa (Goa) Airport:

-

"Best Domestic Airport" at Travel Leisure India's Best Awards 2024

-

First Indian airport to receive “Sarvashrestha Surakhsa Purashkar” by National Safety Council of India Safety Awards 2024

Awards, Recognition and Accomplishments - Continuing to innovate and excel

-

ESG Ratings of GAL: Witnessed Significant improvement in ESG ratings across both S&P Corporate Sustainability Assessment (CSA) and Sustainalytics ESG Risk Ratings, driven by focused ESG initiatives, enhanced transparency and public disclosures

-

Delhi Airport:

-

Earned a coveted spot among the top 10 hub airports in the Asia-Pacific and Middle East Region in the 2024 Air Connectivity Ranking by ACI5, the only Indian airport to make to the list

-

Achieved the prestigious Level 4 Customer Experience Accreditation recognized by ACI World

-

Won Champions of Green Business Practices 2025 at the 4th Edition of the Global Sustainability Alliance Series, hosted by ET Edge

-

Hyderabad Airport:

-

4th fastest-growing airport globally: With a massive 25.6% jump in seat capacity and 1.66mn+ seats in May, GHIAL is officially the 4th fastest-growing airport in the world for 2025 as per Aviation A2Z

-

Awarded 1st Prize in Infrastructure and Construction Category at the 19th National Awards for Excellence in Cost Management - 2024, organized by Institute of Cost Accountants of India

-

GMR Hyderabad Air Cargo (GHAC) awarded the prestigious Integrated Management System Certification

-

The expanded passenger terminal has been awarded the LEED Platinum certification. The terminal earned 84 points from the U.S. Green Building Council, placing it among the highest-rated airport facilities globally for sustainable design and performance

-

Inaugurated India’s first integrated electric vehicle (EV) charging infrastructure tailored for airlines and ground handling operations

1Corporate Announcement dated 26 Jun’25; 2Corporate Announcement dated 27 June’25; 3Corporate Announcement dated 28 Jul’25; 4Non-Convertible Debentures; 5Airports Council International

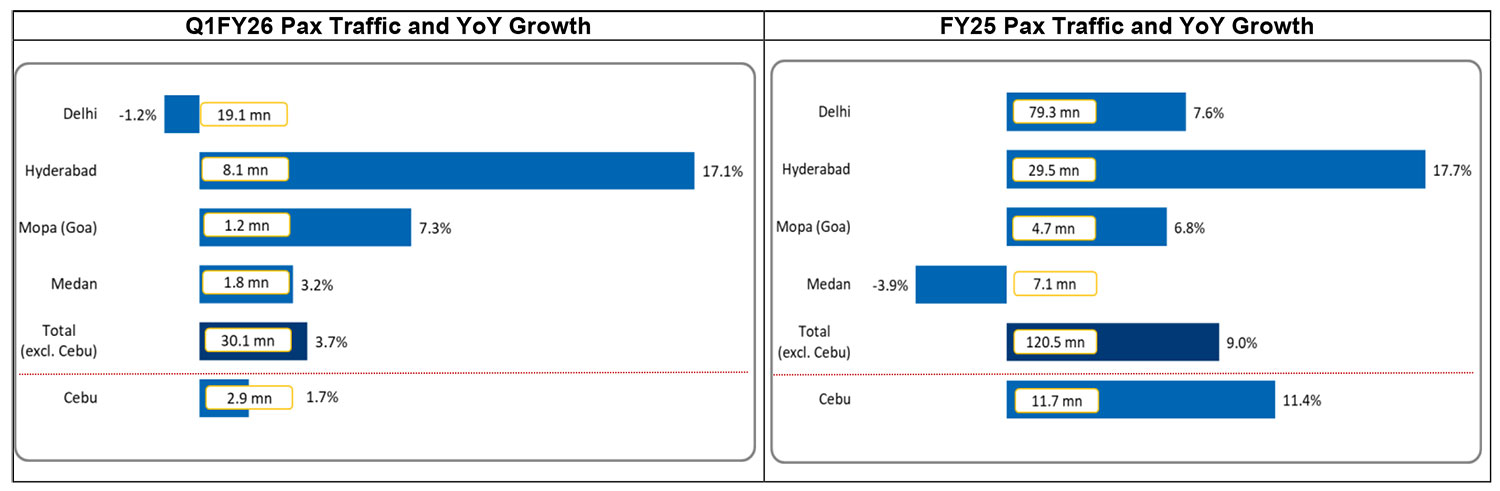

Traffic Trend

Passenger traffic continues to be resilient, with Hyderabad Airport reaching record highs.

Q1FY26 Performance Highlights

Domestic Airports

Delhi Airport (DIAL)

-

Traffic Insight

Q1FY26: Pax traffic at 19.1mn, down by 1.2% YoY from 19.3mn in Q1FY25 attributable to temporary disruptions in flight operations caused by changed airspace conditions amid geopolitical events and Runway 10/28 upgradation at Delhi Airport

-

Domestic traffic decreased by 2.7% while International traffic increased by 3% YoY in Q1FY26

-

Key Financials: Q1FY26

-

Total Income: Increased to INR 1,766 Crs, up by 37% YoY from INR 1,289 Crs in Q1FY25 driven by aero revenues which rose 127% YoY post implementation of revised tariffs from mid-Apr’25

-

EBITDA: Increased to INR 635 Crs, up by 61.8% YoY from INR 392 Crs in Q1FY25. Quarterly EBITDA was the highest in last 4 years

-

PAT: Reported a PAT of INR 49 Crs in Q1FY26 vs. loss of INR 295 Crs in Q1FY25

-

Enhancing Terminal offerings:

-

DigiYatra now live at Terminal 1

-

India’s first-ever airport store by Chanel inaugurated at Terminal 1

-

Opened Budweiser Brew District at Terminal 1

-

Live music, dance acts and other curated experiences now at Terminal 1

-

Opened brand-new arcade zones at T3 International & T3 Domestic with a wide range of games

-

Runway 10/28 currently undergoing CAT-III upgrade, aiming to reduce fog-related delays and enhance winter flight operations

-

Destinations connected – 79 Domestic destinations & 69 International destinations

Hyderabad Airport (GHIAL)

-

Traffic Insight

Q1FY26: Pax traffic increased to 8.1mn, up by 17.1% YoY from 6.9mn in Q1FY25

-

Witnessed highest ever quarterly traffic in Q1FY26, surpassing 8mn quarterly pax for the first time

-

Domestic traffic increased by 19.1%; International traffic increased by 7.8% YoY in Q1FY26

-

Key Financials: Q1FY26

-

Total Income: Increased to INR 625 Crs, up by 8.5% YoY from INR 576 Crs in Q1FY25 driven by growth in traffic

-

EBITDA: Increased to INR 391 Crs, up by 8.0% YoY from INR 362 Crs in Q1FY25. EBITDA for Q1FY26 was the highest on record

-

PAT: Increased to INR 63 Crs, up by 24% from INR 51 Crs in Q1FY26

-

MRO contract win: Akasa Air signed a three-year agreement for base maintenance and support for its Boeing 737 MAX fleet (current fleet size is 30)

-

India’s First Cargo Loyalty Program (“CLIMB”) launched (live from 1 Jul’25). Key benefits include priority cargo handling, Demurrage waivers, Dedicated SPOC and tier based loyalty rewards

-

Destinations connected – 71 Domestic destinations & 25 International destinations

Mopa (Goa) Airport

-

Traffic Insight: at the India Travel Awards

-

Q1FY26 Pax traffic of 1.2mn, up 7.3% YoY

-

Captured ~43% market share (of Goa system traffic) in Q1FY26

-

Key Financials: Q1FY26

-

Total Income: Increased to INR 102 Crs, up by 8.2% YoY from INR 95 Crs in Q1FY25 with Non-Aero revenue increasing 23.6% YoY to INR 20 Crs in Q1FY26

-

EBITDA: Decreased to INR 23 Crs vs. INR 40 Crs in Q1FY25, impacted by commencement of revenue share

-

Steady progress on increasing the Non-Aero offerings:

-

Food ordering Kiosks deployed at Forecourt for KFC & Dominos

-

United Colors of Benetton store opened

-

Achieved ASQ score of 4.96 for the month of June’25

-

Land monetization work progressing towards next phase aimed at mixed use development

-

Destinations connected – 19 Domestic destinations & 6 International destination

Bhogapuram Airport (Visakhapatnam, Andhra Pradesh)

-

Physical progress of ~80% achieved by Jun’25:

-

Airside works ~95% complete

-

Terminal building ~72% complete and

-

Air Traffic Control tower ~87% complete

-

Target completion by Dec’26 including Operational Readiness and Airport Transfer (ORAT)

International Airports

Medan Airport (Indonesia)

-

Traffic Insight

Q1FY26: Pax traffic at 1.76mn; up 3.2% YoY

-

Domestic traffic decreased by 2.2% while International traffic increased by 15.0% YoY in Q1FY26

-

Domestic pax growth continues to be impacted by delay in reactivation of fleets by airlines

-

Key Financials: Q1FY26

-

Total Income: INR 134 Crs, up by 9.1% from INR 123 Crs in Q1FY25

-

EBITDA: INR 29.8 Crs, up by 38.0% from INR 21.6 Crs in Q1FY25

-

PAT: Loss at INR 5 Crs vs. loss of INR 14.3 Crs in Q1FY25

-

Destinations connected – 21 Domestic & 7 International destinations

Crete Airport (Greece)

-

Project is fully funded mainly through State Grant (which is already received) and Airport Modernisation & Development Tax. It is a debt free project

-

Overall progress of ~54% achieved as of Jun’25. Work steadily progressing on multiple front

GAL Consolidated Financial Highlights

About GMR Airports Limited (Formerly GMR Airports Infrastructure Limited)

GMR Airports Limited (GAL) is a leading global airport platform company with over two decades of experience in designing, constructing, and operating world-class sustainable airports. Under the brand name “GMR AERO”, it offers pioneering aviation solutions in retail, aero services, and real estate. Groupe ADP joined the journey in 2020 as a strategic partner and is now a co-promoter in GAL.

As a platform business, GAL also provides a range of aero services including Duty Free, Retail, F&B, Cargo, Car Parking, O&M, and PMC services. Through its innovative Aerotropolis concept, it develops cutting-edge airport cities giving shape to best-in-class real estate developments in South Asia. GAL operates India's largest third-party Maintenance, Repair, and Overhaul (MRO) facility through its subsidiary, GMR Air Cargo and Aerospace Engineering Limited ensuring operational excellence across the Asia Pacific region.

GMR Innovex, a GMR Group entity, is developing and introducing a range of digital solutions to enhance the passenger journey and airport experience. Through GMR Aero Academy and GMR School of Aviation, the company is creating the talent pool necessary to drive the growth of the aviation sector in India (the third largest in the world).

As the largest private airport operator in Asia and the second-largest globally, GAL served over 120 million passengers in FY25 with a steadfast commitment to excellence in airport management as reflected in its consistent rankings for services by ACI and Skytrax. With a robust presence in India and Southeast Asia, the company operates key gateways such as Delhi, Hyderabad, Goa, and Medan airports, while extending its technical services to Mactan Cebu International Airport in the Philippines. GAL is also developing transformative projects like the greenfield airports in Bhogapuram (Visakhapatnam), India, and Crete, Greece.

GMR Group, the promoter of GAL has a significant presence in Energy, Transportation, Urban Infrastructure, and Sports. Through its CSR arm, GMR Varalakshmi Foundation, GMR supports local communities, reflecting its commitment to improving quality of life by enhancing skills, providing education, and developing healthcare infrastructure and services.

Groupe ADP develops and manages airports, including Paris-Charles de Gaulle, Paris-Orly, and Paris-Le Bourget. In 2024, the group handled through its brand Paris Aéroport 103.4 million passengers at Paris-Charles de Gaulle and Paris-Orly, and nearly 363.7 million passengers in airports in France and abroad. Boasting an exceptional geographic location and a major catchment area, the Group is pursuing its strategy of adapting and modernizing its terminal facilities and upgrading the quality of services; the group also intends to develop its retail and real estate businesses. In 2024, group revenue stood at €6,158 million and net income at €342 million.

For further information about GMR Group, visit https://www.gmrgroup.in

Prateek Chatterjee

Group Chief Communications Officer, GMR Group

Email: Prateek.Chatterjee@gmrgroup.in

Subhendu Ray

COE Head-Media Relations, GMR Group

Email: subhendu.ray@gmrgroup.in